Decoding India’s Battery R&D Ecosystem: The Commercialization Challenge

The energy storage sector, which is a critical component of both the renewable energy (RE) and electric vehicle (EV) sectors, is projected to require 600 GWh of battery storage by 2030 – a striking 15 fold growth from 2022. In line with its commitment to achieve net zero by 2070, India is taking rapid strides to develop its economy along low-carbon pathways. To accelerate this momentum, we require substantial investments in research and development (R&D) that can help us create resilient supply chains and a self-reliant ecosystem for batteries.

Lithium-ion battery (LIB) technologies are currently the dominant battery technology in the electric vehicle (EV) sector. This is because they offer higher charging efficiency, longer service life and lower weight. However, there are some technical limitations that need to be addressed and with the help of R&D support, these limitations can be surmounted. Furthermore, emerging technologies such as solid-state batteries and lithium-sulfur can be accelerated for deployment and commercialization.

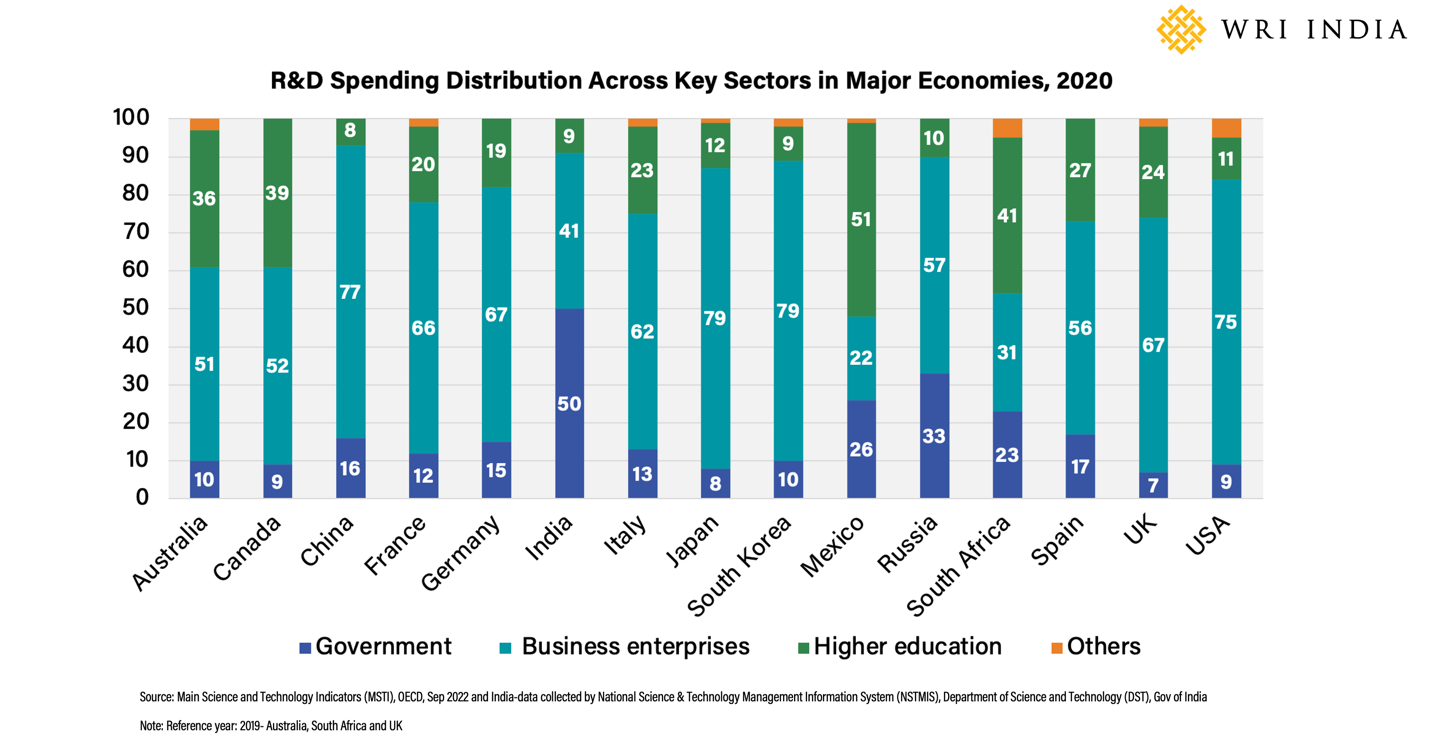

In 2020, India’s Gross Expenditure on R&D (GERD) was 0.64% of its gross domestic product (GDP). This is lower than countries like China (2.4%), USA (3.4%), South Korea (4.7%) and Japan (3.2%). In India, the government remains the primary contributor to GERD while business entities contribute only 41%, unlike countries such as China, the USA, Japan, and South Korea, where business enterprises contribute more than 70%. (As shown in figure 1).

In August 2023, the Government of India passed the Anusandhan National Research Foundation (NRF) Bill to ramp up R&D initiatives. NRF aims to facilitate and finance scientific research and innovation activities across strategic areas such as clean energy, climate change adaptation and battery storage technology. The institution will also foster cross-sectoral collaboration among industry, academia and research institutions, along with encouraging industry to increase spending on R&D.

R&D Focus Areas in the Battery Ecosystem

Battery R&D focuses on different aspects, across the supply chain, including next-generation technologies, modification of materials, design optimization at the cell and pack level, and exploring efficient recycling pathways. These technology developments typically occur in four phases: basic research, technology development, technology demonstrations and commercialization (as shown in figure 2). The maturity of a specific technology or innovation is assessed using a systematic metric like the Technology Readiness Level (TRL), a nine-point scale. (As shown in the table)

| Technology Readiness Level (TRL) | Indicator |

|---|---|

| TRL 1-4 | Basic Research and Technology Development |

| TRL 5-6 | Field Validation and Technology Demonstration |

| TRL 7-8 | System / Subsystem Development |

| TRL 9 | System Launch and Operation |

1. Mapping Focus Areas Of Stakeholders

In India, academic and research institutions predominantly focus on basic research and technology development while industries are more inclined towards innovations in commercial technologies. There are also some emerging public-private partnerships (PPPs) to foster innovation and knowledge exchange in this space.

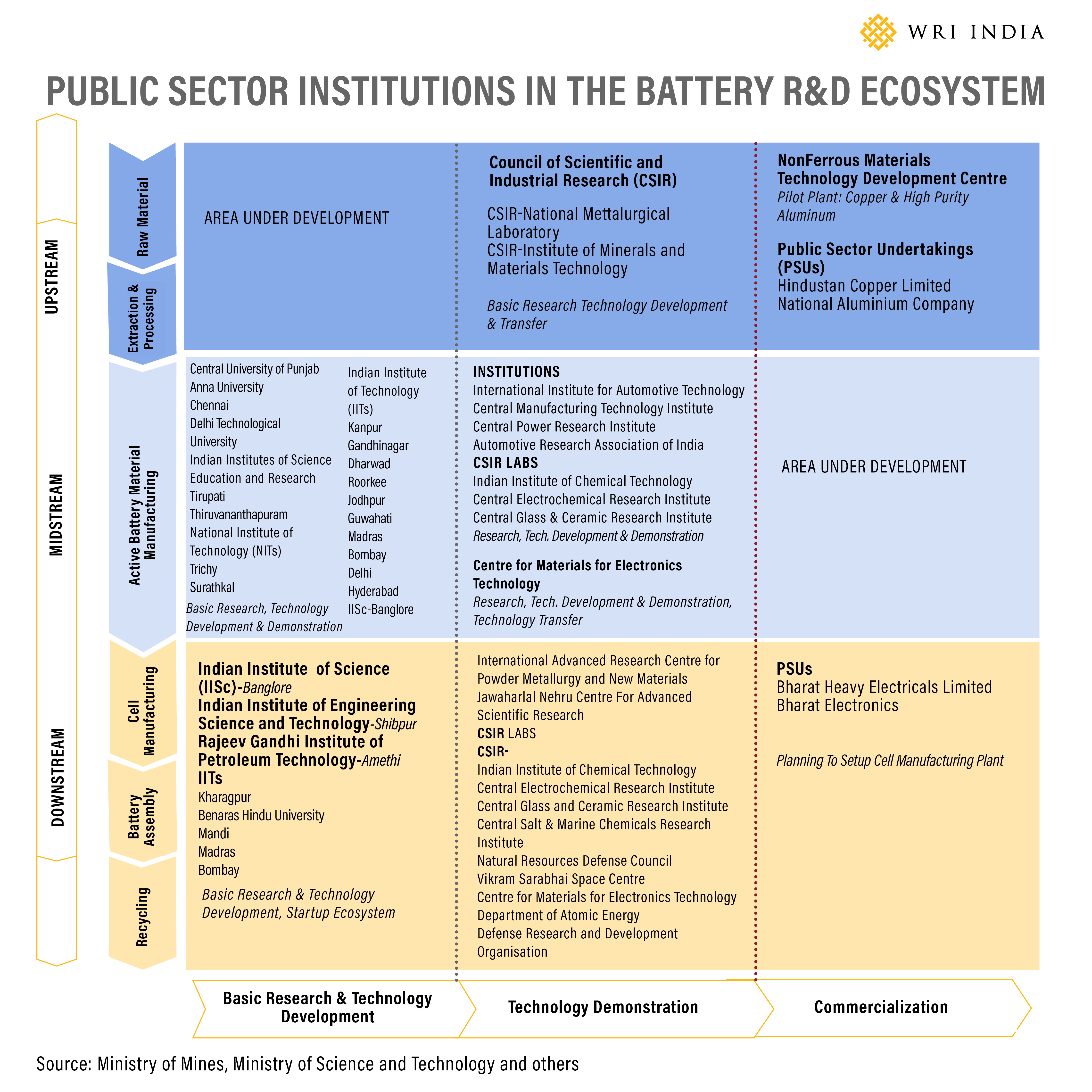

Government Sector: Research institutions, laboratories and public sector undertakings (PSUs) under various ministries are working on various aspects of the battery supply chain and its technological development - from raw material extraction and processing to cell manufacturing and recycling (as shown in figure 3).

Public Sector: Academic and research institutions in India (as shown in figure 4) are at the forefront of battery technology research, with many well-equipped laboratories for TRL 1- 4, and some even having TRL-7 capabilities. Additionally, a few academic institutions have startup incubation centres that enable researchers to collaborate closely with industry and advance their technology for commercialization.

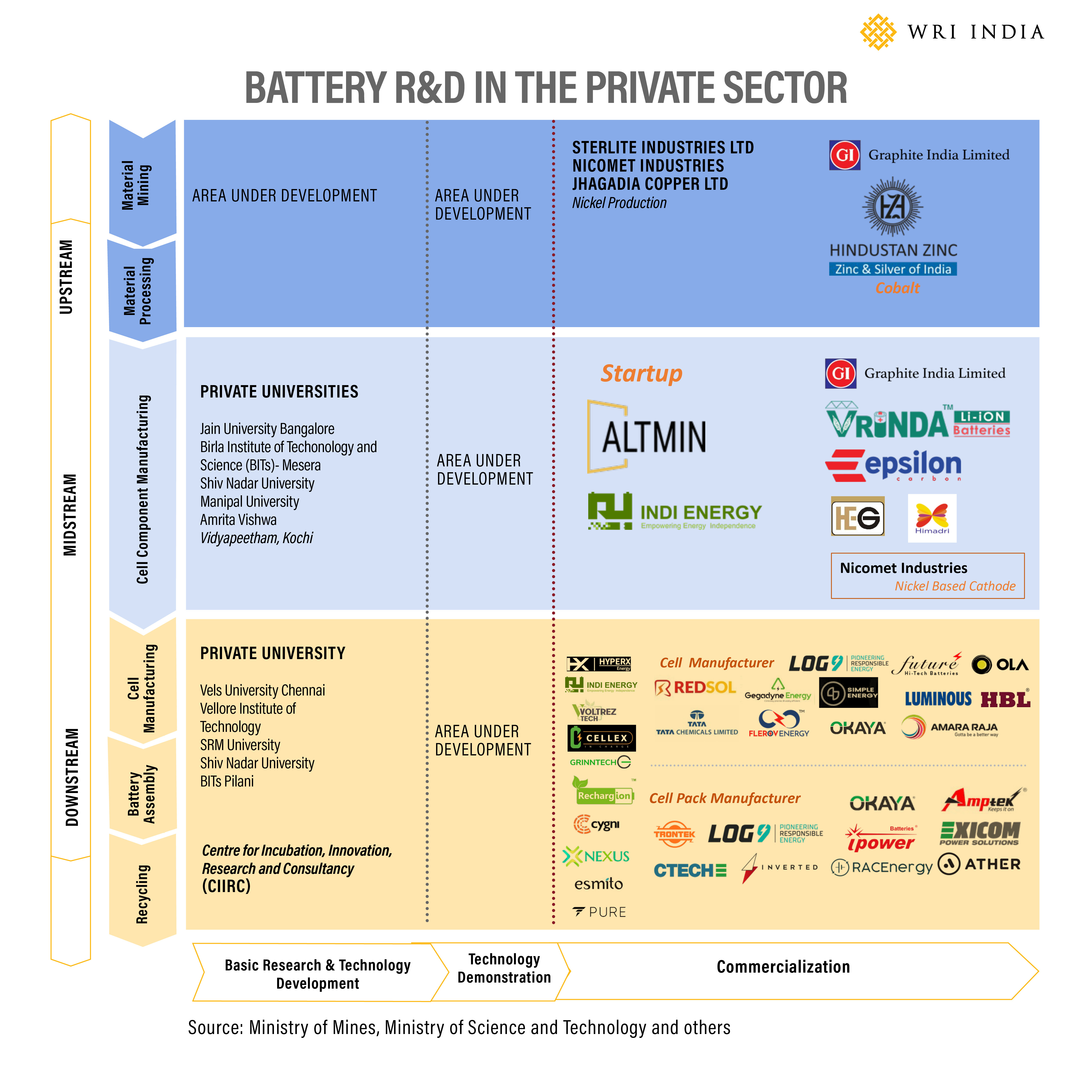

Private Sector: The private sector primarily focuses on enhancing existing commercial technologies as well as developing market-disruptive technologies. Currently, a handful of industries are involved in raw material extraction and processing and active material technology development. Most industries focus on battery pack technologies and a few are in cell manufacturing (as shown in figure 5).

Public-Private-Partnerships: Most PPPs focus on commercializing technologies, especially at the cell and battery pack level (see Figure 6). For instance, the Centre of Excellence on E-waste Management at Centre for Material for Electronic Technology (C-MET) developed and transferred a cost-effective recycling technology, for discarded LIBs, to nine startups.

Policy Initiatives to Support Battery R&D

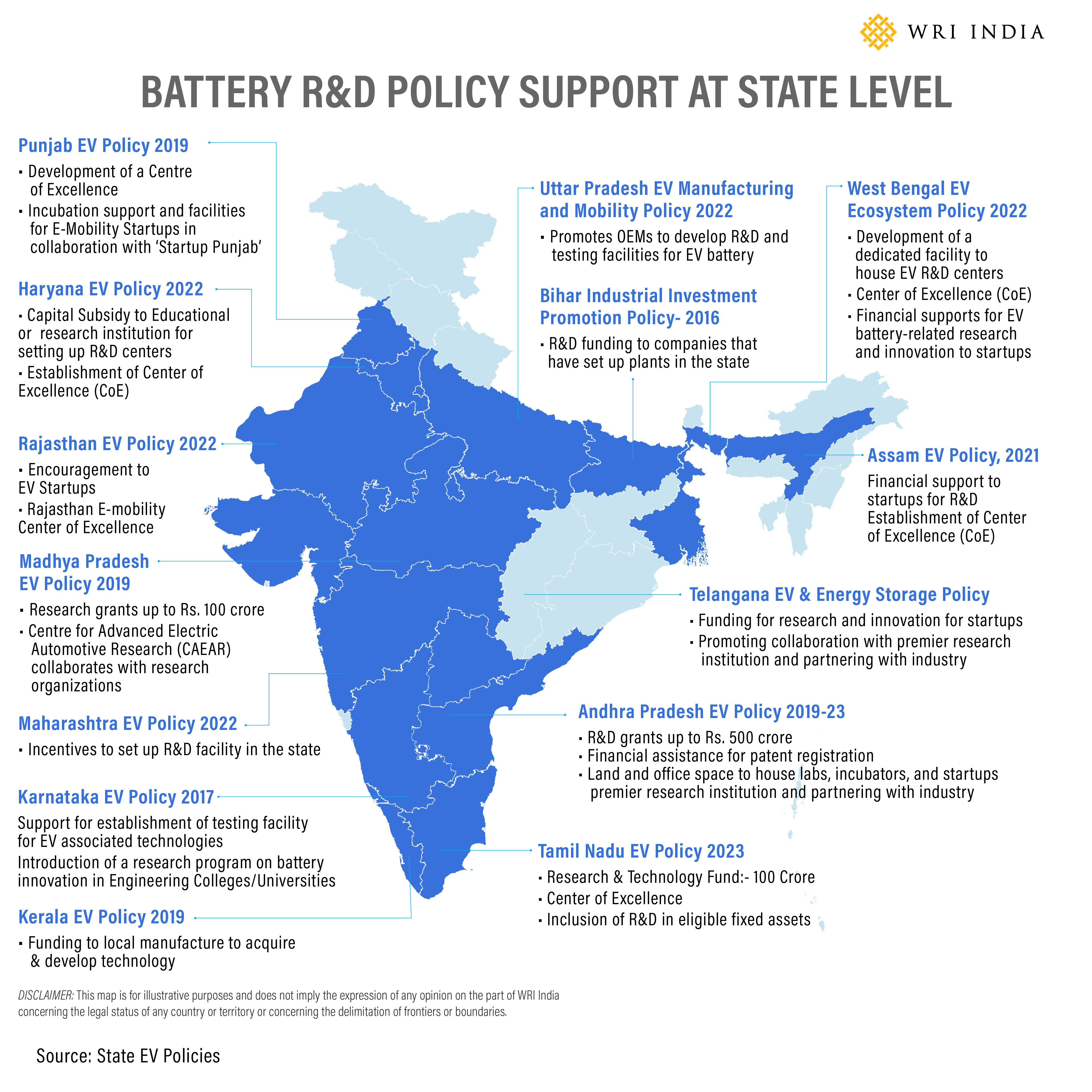

The Government of India is implementing various initiatives such as Manthan Platform, NRF to improve battery R&D ecosystem through funding, incentives and collaborative efforts. State governments, under their specific EV policies, are issuing research grants, incentives and establishing Centers of Excellence (CoE) to promote industry-led collaborations (as shown in Figure 7).

2. Barriers in Technology Commercialization

Most academic and research institutions focus within the TRL 1-4 range with some going as far as TRL 6, involving technology demonstration. However, industries prefer to work at later commercialization stage, i.e. TRL 7-9, revealing a divide between academic research and industrial commercialization preferences (see figure 8). Many of these technologies encounter challenges in validating commercialization or scale-up potential, falling within the range of TRL 4 to TRL 7, commonly referred to as the "Technological Valley of Death". This is attributed to insufficient collaboration and industrial feedback, and lack of technology transfer mechanisms, impeding the process of technology commercialization.

Summary and Way Forward

Academia, research institutions and government laboratories focus mainly on basic research, which is important for setting the foundation for new technology development that can be commercialized through academia-industry collaborations. Following are some recommendations to improve the existing R&D ecosystem in India:

- Strengthen the basic research ecosystem as well as objective-driven research to accelerate innovation in high-priority areas.

- Facilitate multi-institutional R&D collaborations between academia and industry on solution-oriented battery research and design policy tools to enable technology transfer to the marketplace.

- Increase private sector investment in research and innovation and encourage co-financing with government agencies for applied research projects.

- Develop a synergy between various government funding agencies for creating a strategic roadmap and allocate funding in critical areas of battery R&D projects.

- Establish a platform to monitor R&D progress and collect industrial feedback to strengthen academia-industry collaborations.

The complete list of sources for all infographics can accessed here: Battery R & D resources.xlsx.

All illustrations by Safia Zahid and Anindita Bhattacharjee/WRI India.

All views expressed by the authors are personal.